16Apr1:16 pmEST

Still a Big Burden Overhead

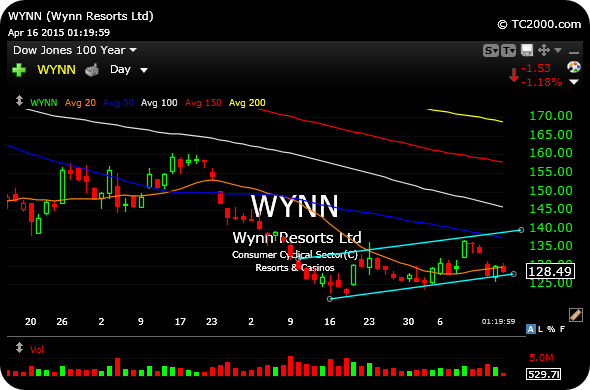

Although the rally in crude, energy stocks, and many materials names has been spirited, fast, and highly unpleasant for shorts pressing at recent lows, the chart of Wynn Resorts may prove to be a good lesson from a technical perspective.

It goes without saying that WYNN is not an energy or materials firm. But it was sold almost as aggressively at times in recent quarters as those sectors were.

And with a declining 200-day moving average (yellow line) above price, rallies should be viewed as opportunities to opportunistically sell (or partially sell, such as with my X long play this week), rather than to complacently assume a major bottom has already been put in place and is a foregone conclusion.

WYNN still may sustain anther rally from here (though the highlighted pattern could easily be another bear flag), but as we can see on the daily chart, below, it has not made life easy on longs, what with the sloppy, random action and fits and starts. The reason for the seemingly random gaps is because of that overarching downtrend, which implies high uncertainty among skittish market players.

And while energy has finally staged that strong snapback rally, flipping green again today, just because a trade has now become treacherous for shorts does not mean it has become an easy long.

There is still big burden overhead.

Two Stocks Finding Comfort i... Once You Go Ack, You Never G...