16Apr10:18 amEST

Watch Duke if the Bond Crazies Start Winning

The top holding in the XLU, ETF for utilities, is Duke Energy, comprising more than 9% of it.

I remain short XLU outright, at $44.26 with a cover-stop over $46.

Regarding DUK, they do not report earnings until May 1st.

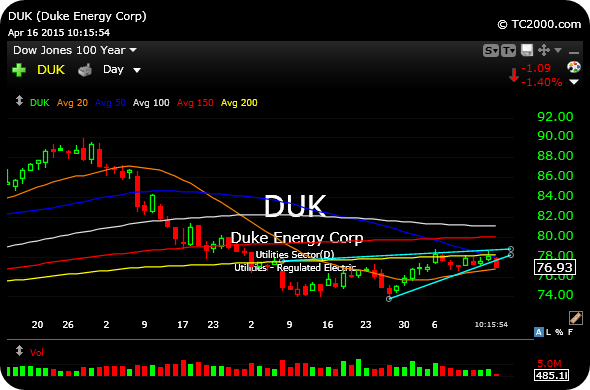

And gauging the daily chart, below, we can see that like most "utes" it is struggling below its 200-day moving average and at risk of breaking lower yet with this morning's weakness.

Of course, this is not an isolated case, as REITs (another rate-sensitive sector, meaning they tend to move in sympathy with bond prices and inverse to rates) have been weak for a while now, led by top IYT ETF holding, SPG.

If buyers fail to step in with any authority today or tomorrow I will likely add to my XLU short and press for a breakdown.

Also note Treasuries themselves (bond prices, inverse to rates), via the TLT ETF, are still rangebound but weak this morning and back on watch for a short.