26May9:55 amEST

They Ain't Pretty No More

While the likes of SCTY and SUNE may still be in play as potential long setups in the solar sector, the reality is that most solars continue to fizzle out just when they need to get going to the upside.

The action in YGE in recent quarters is still a fair warning about just how risky playing the solars can truly be, with Yingli cratering from $41 down to a penny-stock since 2008 despite an abundance of sucker rallies along the way.

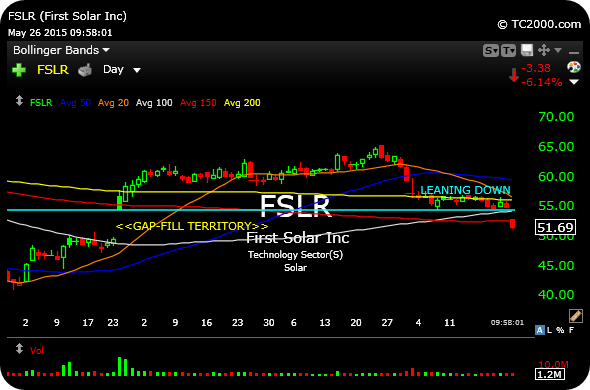

In addition, CSIQ head-faked a breakout in recent weeks. And First Solar has been a textbook short setup, now threatening a gap-fill to $50, seen on the daily chart, below.

Note how FSLR was leaning down against well-defined support, opening up the gap-fill play.

At a minimum, the sector as a whole needs time to set back up again to be anywhere close to worth risking precious capital on the long side. And if crude oil does, in fact, roll back over this summer it is hard to see solars regrouping anytime soon.