28May12:30 pmEST

A Look at the Energy Complex

I took off the rest of an ERY long this morning inside Market Chess Subscription Services, as a way to play the short side of energy stocks (ERY is the triple-bearish version of the XLE, sector ETF). I may look to reenter the bearish bet after a weak bounce.

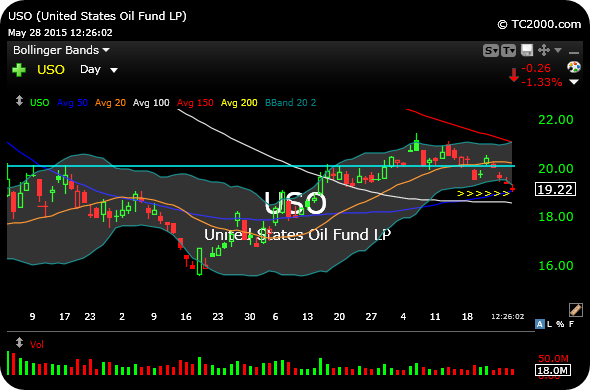

As for crude itself, on the USO ETF daily chart, below, note that crude is now down to its 50-day moving average (dark blue line), as well as oversold, short-term, below its lower Bollinger Band. If bulls are going to show up, now is certainly the time for them to do so. Also note that price failed its initial upside breakout from the long, sideways range.

The above factors were enough for me to take off my bearish bet, with crude being oversold, but not enough to go long yet.

Similar comments apply to the now-oversold natural gas.