01Jul10:22 amEST

A Summer Dip Versus Adult Swim

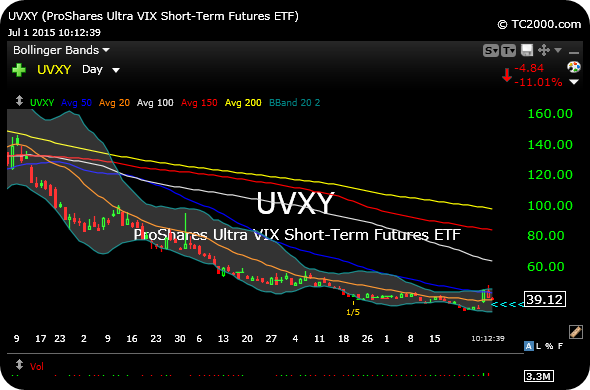

Although I am not particularly fond of performing complex technical analysis on the VIX or the VIX ETFs, a good rough guide for whether volatility has another leg higher coming imminently (in lieu of the usual pop-and-get-smashed pattern we have seen out of the VIX so many times over the last few years) is to gauge the 20-day moving average on the UVXY ETF.

After the 20-day has guided UVXY lower for so long, as you can see on the daily chart, below, the pop over it this week is now checking back to it.

If volatility bulls arrive to defend and press the ETF up and off of it then that should mark at least some change in character in favor of volatility bulls.

Stock Market Recap 06/30/15 ... More Hope Than Evidence for ...