22Jul10:19 amEST

Always Risk of Getting Caught

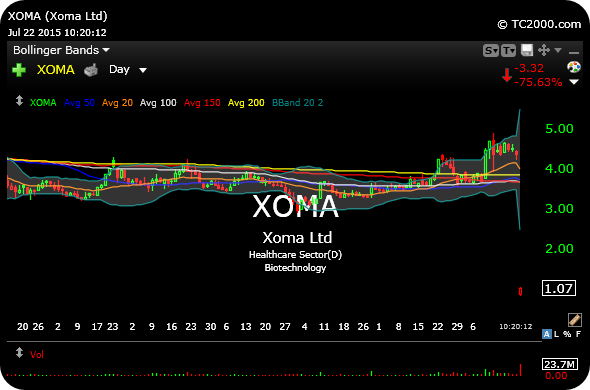

The action in XOMA this morning, down over 76% as I write this, is a good reminder of the inherent risks in small market capitalization biotechnology issues. The stock was down more than 80% pre-market, after the company said a late-stage trial of its treatment (gevokizumab) for Behcet's disease in the eye missed the primary endpoint (source). A move like this one happens far more frequently than many would care to admit, and the main point is to factor this into your risk/reward profile if you choose to enter the trade beforehand by keeping position sizes smaller than usual.

Even in a legendary biotech bull run, it is still worth noting these lessons because whenever we do see the next deep correction or bear market, it is likely the high beta biotechs will undergo serve liquidation even if it does set up a generational buy at some point down the line.

Elsewhere, AAPL did not quite gap down to its lower Bollinger Band, as dip-buyers tried across the board to buy the market's open. Failure to hold a bounce here likely means AAPL can be shorted to its lower Band, currently around $121.

Slaying the Final Dragon of ... Stock Market Recap 11/14/17 ...