06Aug12:44 pmEST

You Always Wait Three Days to Call, Baby

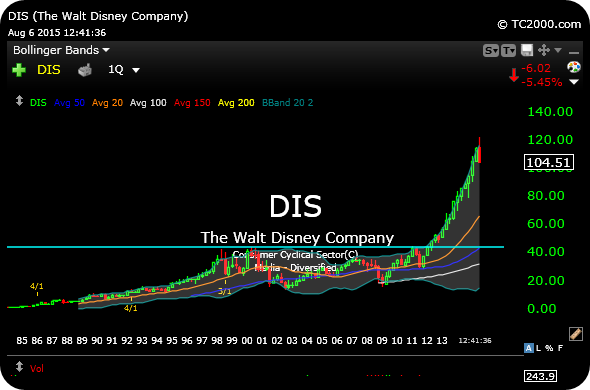

All of the excitement which surrounded the potential "great buying opportunity" presented by the gap down in Disney, post-earnings, seems to have abated today, with the stock following-throigh lower.

After a multi-year steep, strong, and established uptrend, seeing such a sizable gap lower represents a shocking disequilibrium of sorts, insofar as large market players of size likely getting caught off-guard by something in the report. Typically, it takes around three days for some of the larger players to liquidate and decide they want out, on top of the many trend followers taking their cues to hit the exits.

Hence, we do see aftershocks from the earnings earthquakes. And if you do want to play DIS for a counter-trend (short-term) bounce, then waiting three sessions is usually correct first.

For a while now, I had argued that the long-term chart on DIS was too extended to persist for very long. But that did no make shorting it any easier, as any attempts I made usually wound up in small losses as I took my selected shots and quickly stopped out.

Still, the break in long-term trend abruptly wiped out months of gains.

There are two other similar ideas which have not yet snapped off and are actionable, which I will discuss for Members in my usual Midday Video, filming now.

Rain is a Good Thing and So ... Stock Market Recap 02/20/19 ...