07Aug12:45 pmEST

The Clock is Still Ticking for Treasuries

After shorting bonds a few times in the late-spring and early-summer months inside Market Chess Subscription Services, we had backed off the shorts for the remainder of the summer, at least until signs of another rollover were seen.

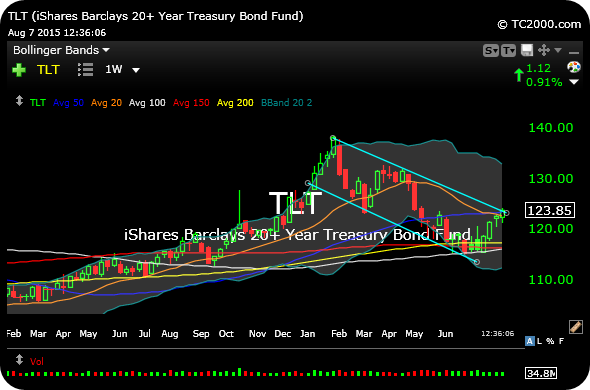

Using the weekly chart of TLT, below, as a very rough proxy for bond prices, we can see a bounce spanning the last seven weeks or so, taking it up to a resistance trendline stretching back to the beginning of 2015.

In effect, Treasuries have been in a corrective pattern throughout this year. And the issue then becomes when we can look for a fresh leg down, now that bond bulls are back to celebrating their legendary resilience, stretching back to the Volcker years in the early-1980s.

I suspect we will have to wait until after Labor Day at this point, perhaps into the September FOMC, before a quality short entry presents itself again.

But as long as yields on the 10-year (opposite to prices) do not breach the 2012 summer lows, the thesis for a multi-decade reversal in trend is still colorable, albeit at a snail's pace as it unfolds.