20Aug3:18 pmEST

We Got This Rat...

Disney, otherwise known as, "The House of Mouse," is finally seeing its share price buckle after an abnormally-steep bull run since at least 2011.

To be sure, timeframe means everything. If you are holding Disney for decades, or at least another 3-5 years, then that is one thing. But for traders and even shorter-term investors (6-18 months), the break in steep trend should be concerning.

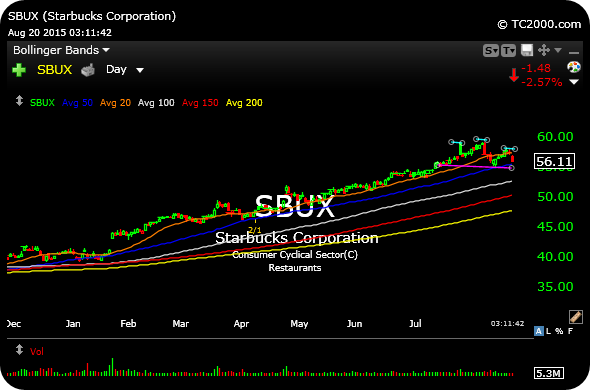

With this in mind, barring some type of KO for Starbucks buyout, I am looking for SBUX to follow DIS lower. Both consumer discretionary stocks (DIS SBUX) have similar steep trends, though SBUX has yet t be snapped off.

I look at SBUX, on the daily chart below, as sporting a potential head and shoulders top confirmed with a close below $54.95. A close back over $58.06 likely renders the thesis null and void.

More in my recaps after the bell, the brief one here and the full-length one for Members.