22Sep10:21 amEST

Like Ships Passing in the Night

There is an air of eerie quiet to this morning's gap lower in the market, which may be a consequence of weeks (or perhaps quarters) of choppy price action rendering many market players too fatigued or lethargic to even become fearful. They may also be complacent, too, since each apparent bout of selling has been bought for a good while now.

Of course, the above is all anecdotal. So, focusing on something even more tangible, the financials are still in hot water after the Fed failed to raise rates. Goldman Sachs is leading the sector lower this morning on the back of the terrible news about CEO Blankfein having cancer.

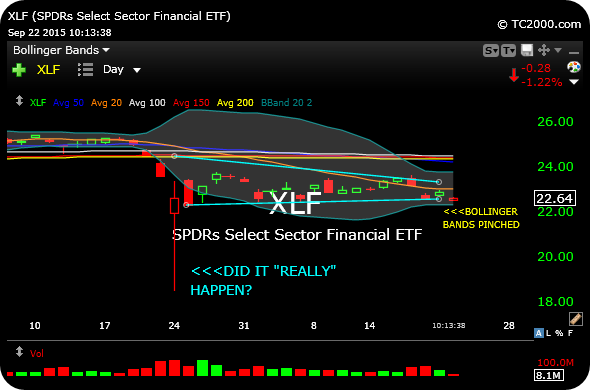

To my eye, for Members we have been observing $22.50 as a critical prior level of support on the XLF, sector ETF seen below on the daily timeframe.

Note the Bollinger Bands, pinched in, indicative of the post-August sell-off consolidation now coming to a head. I expect resolution likely soon, and below $22.50 the bears have the initiative.

Also recall a blog post a few weeks ago, calling into question those August 24th "Flash Crash II" lows, and how they may need to be retested give how quickly they were printed and how many doubt even the actual print.