02Oct2:48 pmEST

Time to Stop Being a Bully

The easiest downtrending stocks and sectors to pick on, such as casinos, energy, even select social media losers, are staging sharp squeezes today, driving home the point of how careful shorts must be even with the S&P 500 Index having traded below its (declining) 200-day simple moving average for roughly six weeks now.

Headed into next week, the likes of BAS LVS TWTR WYNN YELP could easily squeeze much more and still be trading within the context of very bearish overall chart patterns. Of course, that does not make them easy longs either, as many a bottom-fisher has learned the hard way for months, even quarters, on end.

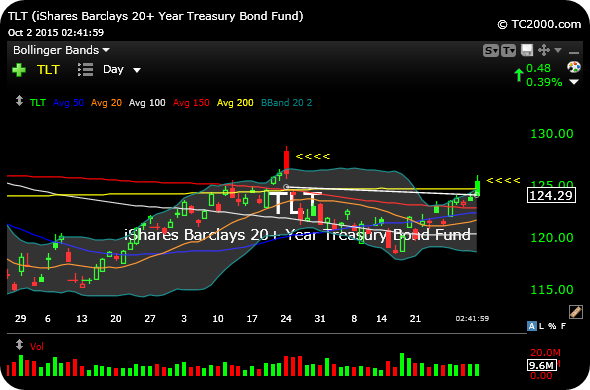

Into the final hour today, it is also worth noting that Treasuries are still holding onto green, but barely.

On the TLT ETF daily chart, below, note the resemblance of today's reversal off the highs of the session to the August 24th candlestick (arrows). If we see any follow-through next week, Treasuries may very well be a tactical short setup.

Walk the Line with Joaquin B... Stock Market Recap 10/02/15 ...