02Oct11:51 amEST

Walk the Line with Joaquin Barreling Down

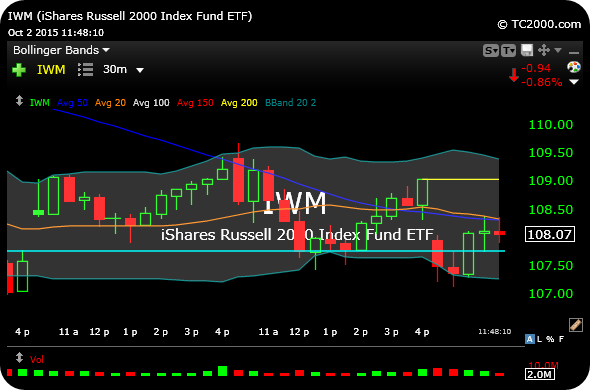

Yesterday we discussed how the small cap ETF for the Russell went ahead and filled its Wednesday morning gap at $107.78. The Nasdaq in the QQQ and S&P in the SPY, however, did not.

With dip-buyers out attempting a reversal in the broad market today, namely in biotech, I am keying off that IWM gap as a good dividing line insofar as determining whether QQQ SPY will follow IWM, or instead if IWM will prove to be an outlier as the Nasdaq and S&P zoom higher.

On the 30-minute updated chart of the IWM, below, the light blue line illustrates the gap from Wednesday at the open.

Also note with the Shanghai closed until October 7th we are seeing a breather for some China-related names which have been torched, such as BABA BIDU LVS MPEL WYNN (Macau). The real test of these bounces, however, will be after the 7th when the selling could easily resume.