08Oct12:27 pmEST

Read Up on Prior Commodity Bottoms

Amid the flurry of oversold rallies in the industrial/materials/energy complex, it is worth noting that commodities can often base out, net-net, for several months to several quarters before beginning a new bull charge higher, notwithstanding the many V-shaped rallies we saw off the March 2009 lows.

That basing scenario would also fit neatly into the bifurcated market we have seen for a while now, with healthcare/biotech/Nasdaq growth names sporting extremely steep uptrends (many of which are now breaking) versus energy/materials/emerging markets suffering steep downtrends. Typically, the way in which bifurcated markets resolve is by seeing the strongest parts break their steep trends, and then the weak sectors stay relatively weak after some initial bounce attempts.

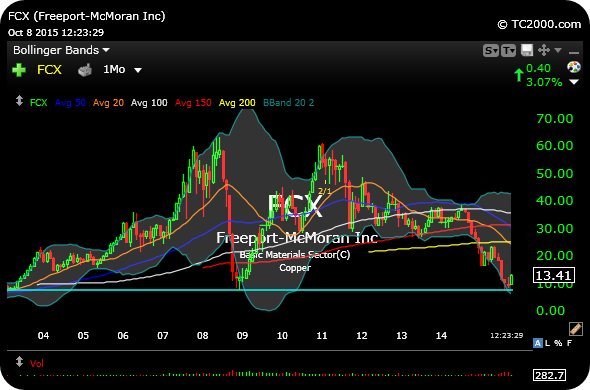

Freeport McMoran, the premier copper miner, serves as a good illustration of the above analysis.

Will Freeport give us a rare, V-shaped rally off its lows like it did in 2008? I would argue it is not as likely this time, but instead would expect, after this initial move off the lows, a sideways basing pattern for a good while, perhaps into 2016. Of course, this assumes FCX has, in fact, put in a good low and bottomed.

We are looking at $12.60 as now needing to hold below in FCX for the bottoming thesis to remain viable.