09Oct10:34 amEST

A Dangerous Kiss

After lagging the market and following their cousins in the Dow Jones Transportation average lower this year, the mega caps in the Dow Jones Industrial Average have been seemingly galvanized by he market snapback rally over the last week or so.

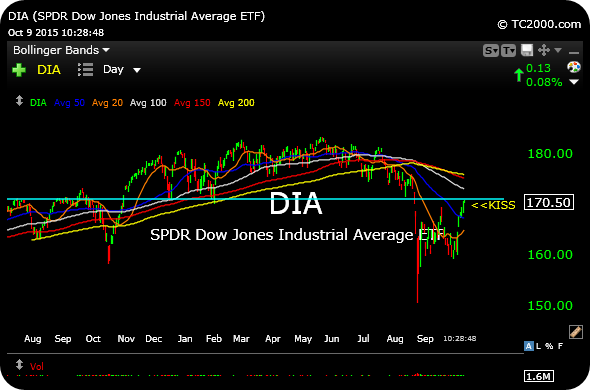

That said, the Dow is still facing stiff prospects lurking above, in terms of declining 150-day and 200-day moving averages. In addition, the Dow ETF, below, "kissed" the breakdown level from August, another likely difficult area.

For all of the V-shaped rallies which this bull run will be remembered for, the concept of overhead supply has served Members well in terms of avoiding the many traps we have seen set since May.

At issue now is whether the Dow can simply blow up through this likely supply area. While another "V" is possible, it is not probable given how much cheer and exuberance with which the current rally has been greeted.

The $171 area on the DIA ETF is likely to cause at least some initial backing and filling, if not more, especially when we see the likes of TSLA lagging, along with small caps and commodities looking a bit sluggish this morning.

The bullish counter-point, worth keeping an open mind to, is if AAPL begins to pick up the pieces and piggyback a rally higher out of its current lagging phase.

Stock Market Recap 10/08/15 ... A "Bad Reviews is Good Revie...