02Nov10:34 amEST

More Needed to Silence the Lambs

Crude oil and energy stocks are reversing to green this morning, bucking the red seen throughout the rest of the commodities complex. The gap down in natural gas, for example, drives home how arduous of a task it can be to swing trade damaged charts without a precise setup.

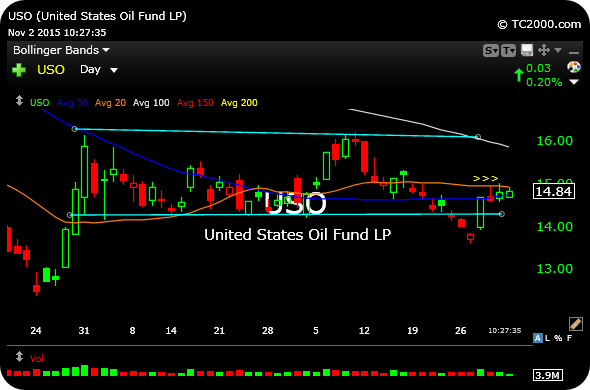

If crude oil is going to make some noise for a secondary leg higher off the August lows, I suspect the daily chart ETF, below, must break and importantly hold over $15. Otherwise, I would surmise we see more trend-less chop where bulls and bears alternate days claiming victory.

Turning to equities, biotechnology shares are leading this morning, while retail/consumer discretionary lag. CMG and V are notable leading laggards, but thus far the market seems more inclined for rotation.

I have my eyes on a few setups if the rotation keeps up, discussing this morning for Members on the private feed.

Weekend Overview and Analysi... This Game is Not About One P...