12Nov2:13 pmEST

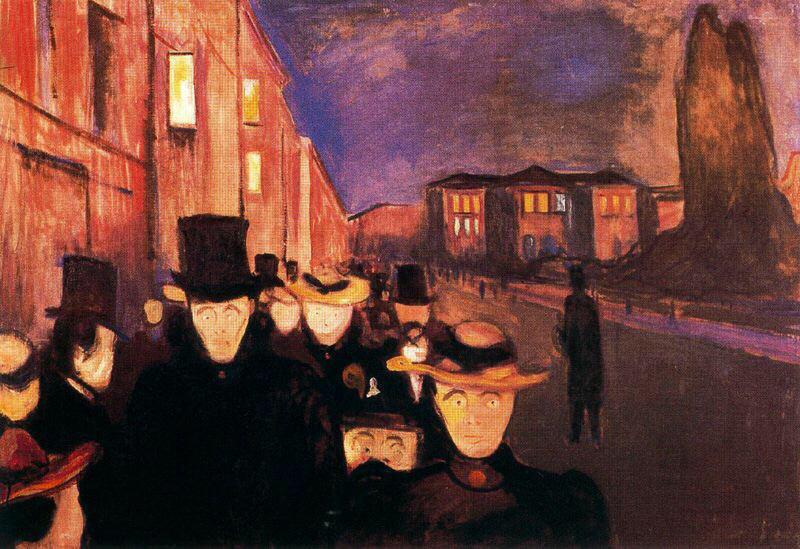

Mob Mentality

Given the run-ups and how steep their respective angles of ascent have been in many biotechnology and healthcare names, it makes sense that the dip-buying mentality will continue to stay alive until it is smashed to smithereens.

With respect to the XBI, ETF for the small and midcap biotech firms, the 30-minute chart typically would spell technical trouble, with a mini bear flag (purple lines) forming within a larger descending triangle off the late-September lows. But just as with any bear thesis in this market climate, it needs to be tempered with the usual caveats about overnight Central Banker surprises, false breakdowns, etc..

Still, the chart speaks for itself, with $69 having been a level we discussed for Members on a daily basis for XBI as being an important one. Many of the newer traders since 2013 have enjoyed the mob mentality of a one-way uptrend, but I suspect they could easily see the flip side of the mentality if and when a low swing high is put in and leads to fresh lows.