20Nov10:39 amEST

Nike: Just Poster Child It

Headed down the home stretch of 2015, a likely popular topic will now be whether fund managers chase up winners into the holidays while leaving underperforming stocks and sectors by the side of the road.

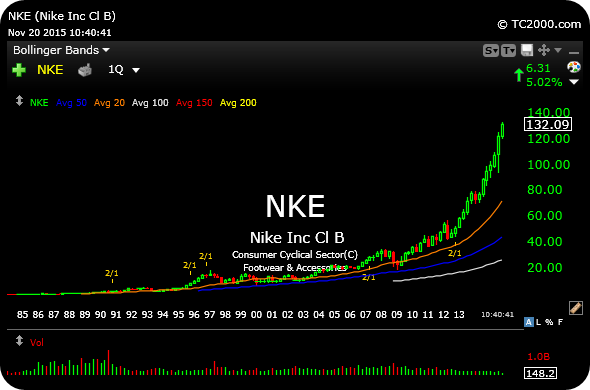

Nike may very well be the poster child for this issue, and undisputed winner for years on end now. I have argued that the long-term chart has essentially gone parabolic, particularly unique to a firm with its market capitalization and known growth.

But with NKE unveiling a tasty cocktail of announcements last evening, the stock is gapping up over 5% as I write this.

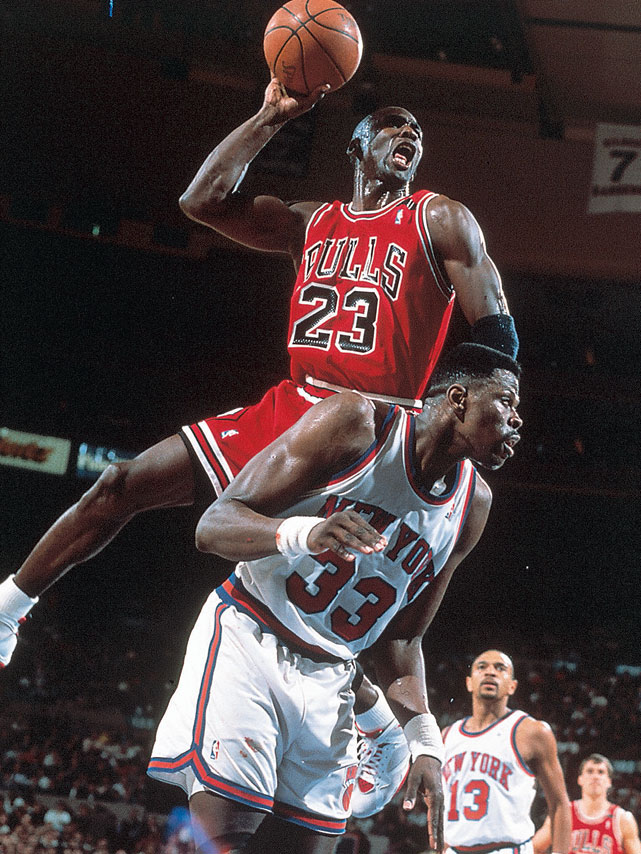

First, the updated quarterly chart, first below, showing the very steep long-term angle of ascent which has yet to break. I still maintain NKE will follow the likes of SKX lower in this category, though perhaps not with as much gusto or velocity.

Next, the daily chart, second below, showing the gap back up to recent highs. If sellers start to creep in next week it may very well be worth a shot on the short side with a defined and tight stop over $134 or so. Otherwise, the year-end melt-up for the few, the proud, the huge winners would seem inevitable, with Nike being the poster child for the group.

Also note Under Armour has retraced up to the scene of its broken head and shoulders top neckline now. We played UA on the short side and covered it early in the week for a win, but it may be back in play as an actionable short next week again if NKE, too, falters at recent highs.

Stock Market Recap 11/19/15 ... It's All About 206 for Those...