17Dec3:33 pmEST

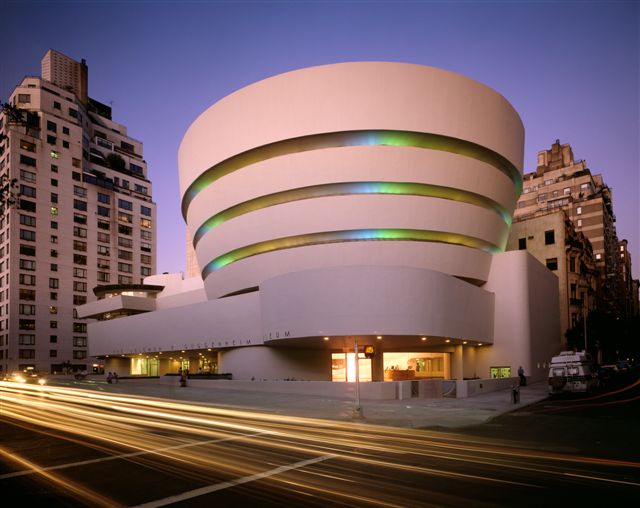

This Chart Does, Indeed, Belong in the Guggenheim

It is fitting that in a market with long-running divergences and bifurcations, we are closing out t2015 with the weaker parts of the tape seeing their underperformance exacerbated further.

It was just yesterday that we noted the SEA, a Guggenheim Investments' ETF product of the shipping sector, plunging to fresh multi-year lows.

And today, with prominent tanker TK plunge 60%, among other carnage in the sector, SEA is entering a likely capitulatory/washout phase, with its angle of descent headed straight down.

So do you buy the blood in the sea here?

Typically, the wipeout phase can be a one-to-four day event, which means waiting until next week to look for a quick bounce is likely correct.

But the bigger picture is that the extreme carnage in certain parts of the market continues to keep a lid on the many bull theses out there for an imminent breakout to new highs, at least one where we have broad-based health participation.

Energy Bulls Are Playing the... Stock Market Recap 12/17/15 ...