19Jan12:48 pmEST

Secular Arguments Running Out of Time

The theory that equites commenced a new secular (meaning structural, long-term) bull market in 2013 gained more and more traction as the S&P 500 Index held over its 2000 and 2007 highs for a good while, as the Dow, Nasdaq, even Russell followed suit. On the surface, a new secular bull seemed to be a foregone conclusion.

But that analysis ignores many instances in history where a specific sector(s) in the crosshairs of the prior secular bear market fail to make new highs, surpassing the pre-bear highs, some 20-25 years later.

As we know, the most recent structural bear market began in 2000 with the dot-com bubble popping. followed up in 2008 with the debt bubble. The two sectors in question: Semiconductors and financials.

Both the Philadelphia Semiconductor Index and the XLF, financial sector ETF, have come nowhere close to surpassing their 2000 and 2007 highs during this latest bull run throwing a wrench in the new secular bull argument. So what does that mean? In all likelihood, it is likely a matter of semantics as long as we go nowhere close to the March 2009 lows of 666 on the S&P.

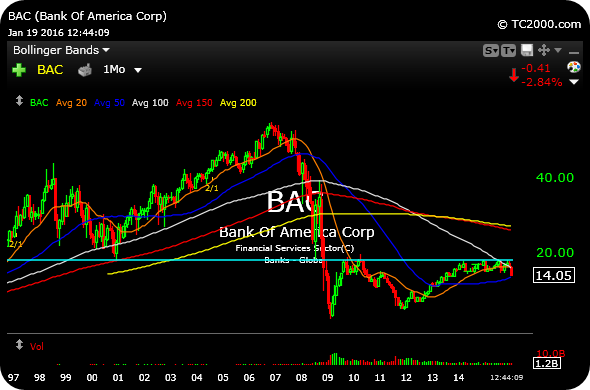

However, the weakness in BAC today after losing early strength, combined with its monthly chart, below, showing price struggling to recapture its post-2008 crash highs (let alone the pre-bear market highs) undermines the notion that market players must play catch-up to the indices by going long financials and semis, even homebuilders--In reality, these sectors were at the epicenter of a secular bear market which not only may not be dead, but may be reasserting itself as the dominant secular theme this year.

Simply put, the SOX, XLF, and XHB are not likely to surpass their pre-crash highs until next decade, which is likely to continue to be a drag on any goldilocks thesis.

I will discuss today's market, with ideas and setups, for Members in my usual Midday Video.

The Myths Around the First T... Saturday Night at Market Che...