03Feb10:42 amEST

Japan Losing the Battle of Midway Versus Its Own Currency

Despite going to the extreme measure of negative interest rates, the Bank of Japan has not been able to keep the Japanese Yen down for very long. As we have discussed previously, the Yen is often seen as an inversely-correlated currency to thriving global risk appetite, which means when the Yen rises it is often seen in conjunction with falling equity prices, for example.

While this correlation is not always step-for-step, in the current global market climate of Central Bankers largely looking to fight perceived deflation threats at all costs, igniting their respective economies by discouraging savers and encouraging speculators while slashing rates and the value of their currencies, to see the market fight back in the manner the Yen has in recent days is something to behold.

While the knee-jerk reaction may be to argue that a given market is "trading on global macro," or "trading on fundamentals," in reality at any given moment the technicals of the chart often matter most once a news item is already known or knowable.

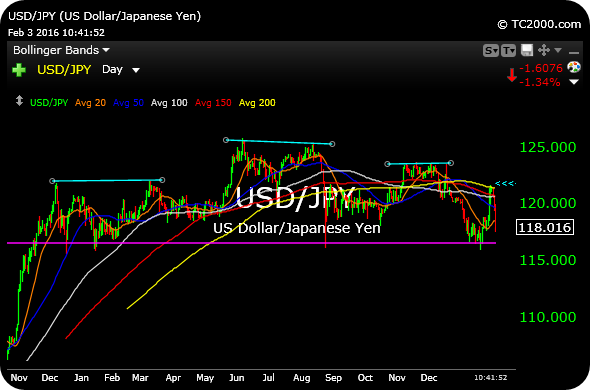

Specifically, on the updated daily chart of the U.S. Dollar/Yen currency cross, below, where the Yen is the denominator, note the reaction at the declining 200-day moving average despite every effort by the Bank of Japan to ignite this pair to new highs. Note that this is the midpoint of a potential head and shoulders top, outlined, which is about as far as bears want to see the bounce go.

On the other hand, the outlined potential top has yet to be confirmed, as currencies at-large are still in limbo with the Dollar selling off and the Euro rallying.

But regarding the Yen, specifically, the lower this chart goes, the higher the Yen reaches and the more havoc we can expect in global markets as they lose confidence in the once-unorthodox policies of Central Bankers which are becoming increasingly conventional and, thus, less potent.

Stock Market Recap 03/11/20 ... Stock Market Recap 03/12/20 ...