09Feb12:36 pmEST

First in First Out of Port

With crude oil and high yield paper pushing session lows as we speak, stocks are wobbly but have not plunged to follow suit, just yet. Into the afternoon, the crude oil weakness is a concern, but shorts should still not rely on it as a proxy to short tech and biotech, for example.

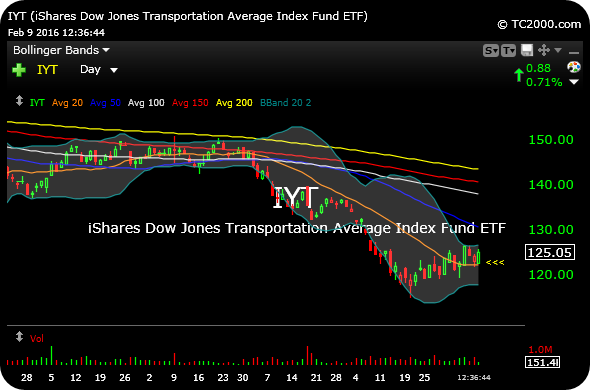

At the moment, a more interesting development to my eye is the price action in the transportation sector.

Recall that the transports, as a group, topped out the day after Thanksgiving...in 2014. We have remained soundly bearish on the sector, by and large, ever since. Also recall that the naysayers of how crucial transports are to the economy and market have since toned down the rhetoric in terms of trivializing the IYT's heavy and steady selling over the last fourteen months.

Having said that, the transports are flashing a slightly bull divergence here. On the IYT (sector ETF) daily chart, below, note the transports holding over their 20-day moving average up nicely on the session.

The best bull argument, still unproven of course, would be that the transports were the first to enter a bear market, and now may be the first to emerge.

But putting the long-term extrapolations like that to one side, in the short-term the IYT holding over the 20-day moving average may keep bears at by for stocks as a whole even as crude swoons again.

I will those topics and plenty more for Members in my usual Midday Video.

Tesla's Not-So-Electric Slid... It's Not Just Apple Being Se...