08Mar10:50 amEST

Other Side of the Boat

The action this morning in the market is nearly opposite what we saw yesterday with biotech, miners, and small caps all leading to the downside while FANG an the likes of NKE show relative strength. This type of rotation may be a function of money simply being shuffled around looking to make something happen, instead of flowing with a more coherent rhyme or reason. In addition, the URBN gap up after earnings does not seem to be helping other retail names too much, with even the most tempting go setups like COH KORS still moving sideways.

I suspect a multi-day pullback for the miners/materials/energy stocks may be just the right touch to set-up some lower risk, actionable longs for swing trades. But in the meantime it is important to not assume anything, regarding a potential bear market bottom, as that type of mindset has surely destroyed tons of capital the last few years in those sectors.

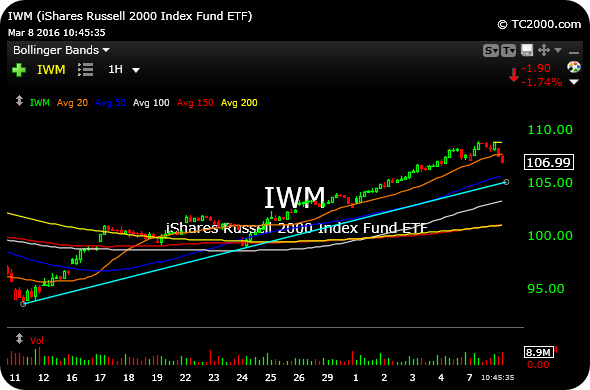

As for the broad market, the Russell 2000 Index ETF, below, may have a date with the $105 area, below, which would coincide with a basic support trending drawn dating back to the February lows.

Stock Market Recap 03/07/16 ... Now We Find Out if the Paper...