11Apr10:44 amEST

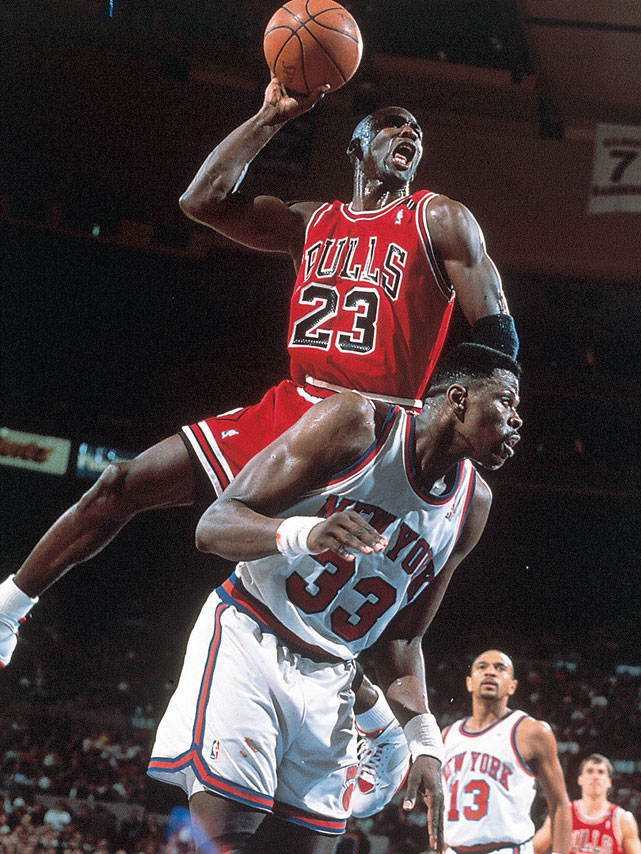

Number 23 is Still the Best

The XME, ETF for many metals and miners, is outperforming most sectors this morning, notably biotech and a few prominent growth issues like FB NKE UA.

We trimmed some partial gains in a few precious miners, but are scouting out some fresh longs in other parts of the XME holdings.

Regarding gold miners, the weekly chart for the GDX ETF, below indicates that a $23 upside target makes sense as a logical price magnet. While many miners are now short-term fairly overbought, there may be too many shorts looking to fade the move for it to fail here.

Moreover, the continued weakness in the U.S. Dollar (UUP is red again this morning, for example) is likely a tailwind for metals and miners.

Once the $23 level is hit, it should represent the next test in assessing whether the precious metals and miners have begun a new bull market, given their lack of giveback since the rally began in late-January.