15Apr10:46 amEST

Why're You Tryna to Get Crazy with Inflation, SID? Don't You Know the Central Bankers Are Loco?

I will let the macroeconomic experts and Fed-heads deal with the "why," but the steels and precious miners are tightening up quickly on this pullback.

After some shaking and baking yesterday, silver miners, for example, are firm and possibly bull-flagging for yet another push higher next week. Note how the silver metal has given back next to nothing on this recent consolidation, whereas gold and now crude oil have come in to some degree.

Beyond that, the steels may be the more underrated sector in the entire market right now, given their high buy volume surges over the last fee weeks.

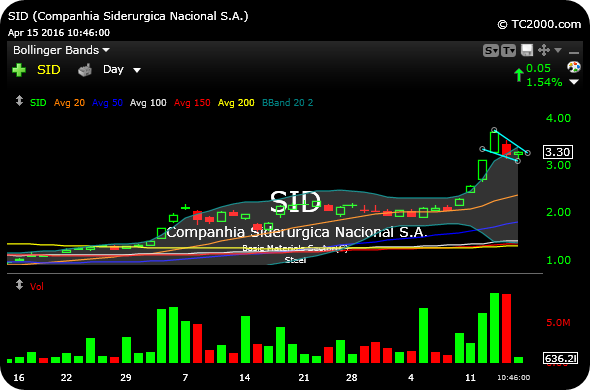

A few Members have been playing the fast-moving hot tamales, such as Brazilian steel play GGB. In addition, SID, another high beta Brazilian steel seen below on the daily timeframe, is tightening up for a promising bull flag.

How to play these potential bull flags still requires some care, especially into the weekend, and especially with high beta commodity names trying to prove a new bull run and the end of a multi-year angry bear market. Controlled position sizing and firm stops still make sense, as does taking gains into strength, for now at least.

But regardless of whether this type of action points towards actual inflation down the road, steel and miner bulls have made a compelling technical case thus far in 2016.

Labor Day Overview and Analy... Someone Needs to Set Up a Sp...