18Apr10:50 amEST

Sending Energy Bears Up the Tree

Despite a massive downside gap in crude oil futures last evening off the inability for a deal to materialize in Doha over the weekend, USO is down just under 3% and coming to terms with the $10 level on that ETF which has been significant previously.

Moreover, and perhaps even more concerning to energy bears, the energy stocks are flashing green and essentially shrugging off the Doha news, at least for now.

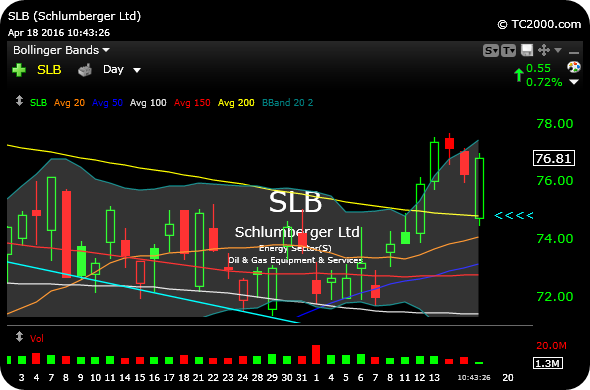

Going forward, we want to key off SLB, the XLE and OIH titan. "SLoB" reports earnings later in the week. But as long as that 200-day moving average holds like it did magnificently this morning (yellow line on daily chart, below), it will likely keep sending energy bears up the tree. Also key off XOM at $85, another clear heavyweight in the XLE.

We also have our eyes for Members on a few small and mid-cap biotechnology issues outperforming again this morning and are capable of vicious short squeezes.

Weekend Overview and Analysi... It Ain't About Blockbuster A...