26Apr1:01 pmEST

Apple Innovation Put to the Test

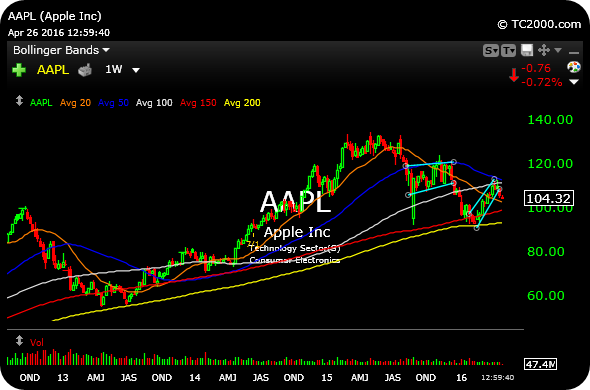

Looking at the weekly chart for AAPL, below, the pressure sure seems to be on bulls to execute after tonight's earnings report.

Even with a multi-week rally into April, Apple has been printing lower highs and lower lows, simply put, since last July 2015.

And headed into earnings you might argue the rally has simply set up yet another "bear flag" continuation pattern which is ripe to break lower, barring some positively surprising news tonight.

Beyond Apple itself, though, I suspect tonight's earnings report and reaction will carry additional significance for chips, which have been in limbo of late in the SMH ETF. If AAPL falters, the likes of ADI SWKS TXN likely set up as shorts, whereas a rally probably enables SMH to clear $55 to the upside.

More on the market and specific ideas in my usual Midday Video for Members.