20May10:42 amEST

These Freedom Fries Don't Run

As has been the theme of recent blog posts regarding the U.S. Dollar, even though miners stages an explosive rally in the winter and spring months we need not get carried away assuming the greenback will meet its demise in a straight line to the downside.

And then there is also the issue that King Dollar has just staged a bear trap for the ages in the way of a false breakdown which then propels it on a new bull run.

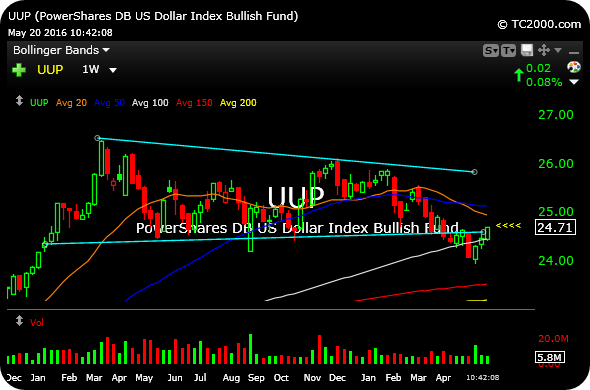

On the weekly chart for the UUP, Dollar ETF versus the basket of develop economies' currencies, what we can say with certainty is that the bounce is still in progress. Whether it is the beginning of a new bull run after the bear trap has been sprung, or instead is simply the kiss of death (to the breached lower light blue line, fifteen months of prior support) before rolling back over remains to be seen.

As that King Dollar bounce unfolds, we are looking to see which commodities and miners exude relative strength, so as to be prepared when the Dollar gives us more information about its next true move. In other words, should the Dollar roll back over we must be armed with the best performing commodities and miners, ready to pounce.

At the moment, soft commodities are hanging in there, as is a steel like RS which we looked at yesterday, while gold, silver, and the precious miners flipped red in the face of the UUP staying green.

Either way, the inverse relationship between the Dollar and many commodities/miners is worthy of continued attention.

Stock Market Recap 05/19/16 ... With This Market, You'll Nee...