26Jul12:50 pmEST

The Pain Trade Cometh

.png)

Headed into the afternoon portion of the session, equities are by and large working through a very short-term sloppy pattern (within an intermediate-term tighter one) on the major averages.

In all likelihood, it is tough to become overly-aggressive in front of some premier earnings reports, The Fed, and GDP later in the week. To be sure, however, notable outperformers are declaring themselves.

Specifically, the outperformance in the XME, sector ETF for metals miners (precious and otherwise), is noteworthy today. Steels continue to cement their resurgence in 2016. We are playing them inside Market Chess Subscription Services and have our eyes on a few others.

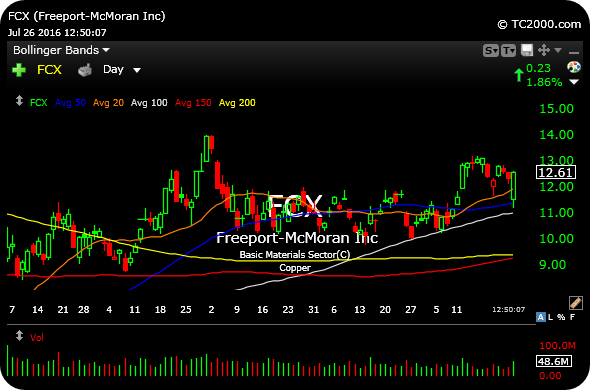

But beyond steels, the earnings reaction today to copper miner FCX is perhaps even more telling. Freeport missed earnings and initially sold off fairly hard.

However, as I write this FCX has come screaming back to green on pretty good buy volume. On the updated daily chart, below, you can see the stock is back in good shape technically, above all moving averages and basing under $13.

Surviving and then thriving after the FOMC is the next hurdle for XME, but so far the pain trade may be revealing itself as fund managers scramble to take on mining inventory after years of abhorring the sector.