02Aug1:12 pmEST

Clawing Back for a Fight

In the midst of Japanese Government Bonds (JGBs) suddenly selling off hard, the risk averse Japanese Yen currency is surging again along with precious metals today.

Treasuries are suspiciously weak. But the larger issue is the Yen exploding for a potential new leg higher. If that materializes, along with the crude oil weakness, stocks may have enough reason to at least pull back a bit more after a multi-week stalemate on the S&P as the Nasdaq took over the leadership reigns.

As you might imagine, even the lowly VIX is clawing back for a fight amid the strong Yen.

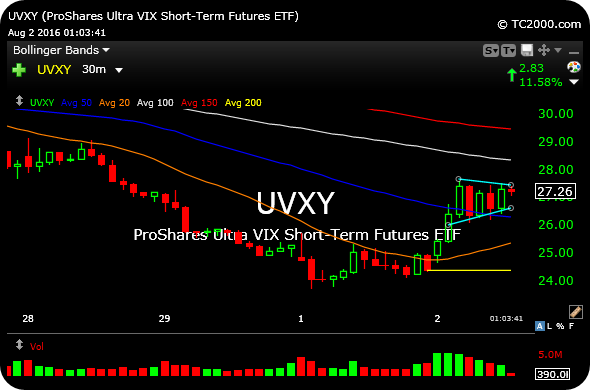

On the 30-minute chart for UVXY, the levered long VIX futures ETF, note the tight pattern since this morning's gap higher. Another push higher this afternoon is certainly a possibility and should be respected.

I see many traders harping on the S&P 500 back down to its 20-day moving average, anticipating support. But recall that moving averages only represent potential support areas until we see actual evidence of buyers fortifying it, which has not yet happened.

More in my usual Midday Video for Members.

Let's Find the Real Apex Pre... Europe Needs a New Marshall ...