10Aug10:50 amEST

The Train Did Not Leave the Station Yet

A major part of analyzing markets and trading is being able to constantly revisit a given thesis and update it as objectively as possibly; being willing to entertain several scenarios and then seeking to narrow down based on odds and probabilities.

In the case of some major consumer leaders over the last several years, we have seen a changing of the guard of sorts, discussed on this website and for Members regularly.

Specifically, the likes of CMG DIS NKE SBUX UA have been glaringly weak, not just on a relative basis to the market but at times on an absolute basis as well.

At the same time, they have not come crashing down from their multi-year advances quite in the same manner as a pure momentum run would implode (think CREE many years ago, and DDD in recent years).

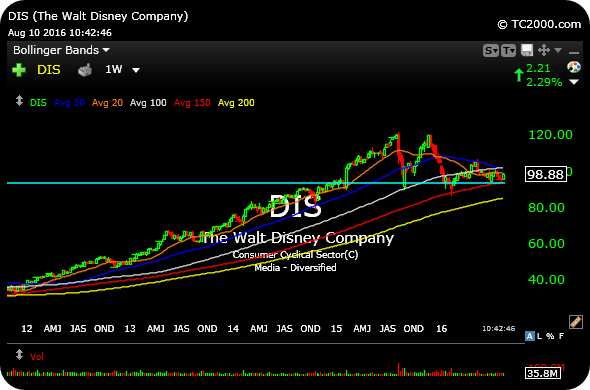

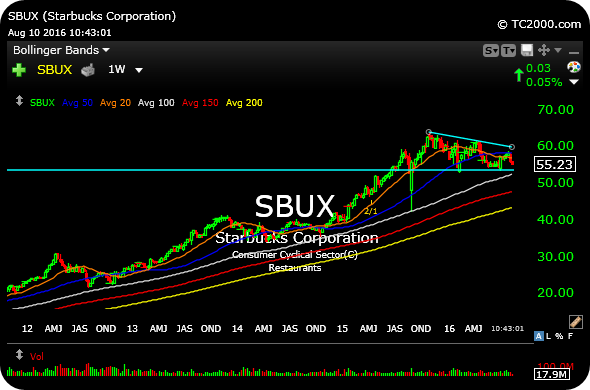

On their respectively weekly charts, below, DIS and SBUX illustrate as much. Both sustained brilliant multi-year rallies as bonafide large cap consumer leaders based out of the quintessential consumer-driven economy, with diversified global expansion, to boot.

Despite how bearish they have appeared at times, and how correct it may have been to largely avoid them on the long side, it is still worth noting that neither have broken their very well-defined horizontal major support lines, defined in light blue on each chart.

If DIS moves below $94 again and SBUX below $53.40 I suspect the bear thesis will become more viable again. But those trains have not yet left the station. And with the broad market as resilient as it has been of late, it may be worth waiting until we see some more volatility kick in before pushing them on the short side in the near-term.