06Oct1:21 pmEST

Any Excuse Will Do for a Move

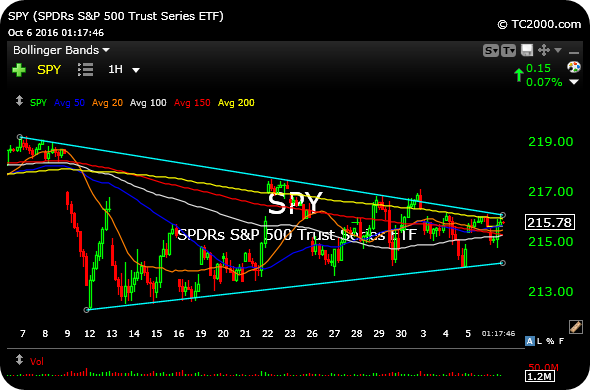

It is not so much that tomorrow morning's jobs number is going to be a data point of great significance to the market. Instead, observing the S&P 500 Index's ETF on the hourly chart since Labor Day, below, I suspect stocks are looking for any excuse, rather than a catalyst per se, to break its narrow range and sustain a move with a bit more staying power. In the meantime, staying light and tight with overall portfolio exposure has been a good defense against the alternating red and green gaps on a daily basis.

Having said that, a few notable groups continue to outperform and are being magnified today, given the price action, such as the medical device stocks. I will highlight the best of them for Members in my usual Midday Video.

Also, to update TWTR from my earlier post, the stock may very well be in near-term (intraday) washout mode beyond the huge gap down this morning. A "three day rule" may very well apply here, stepping aside until next week to see if lower risk entry presents itself, if at all.