13Oct10:54 amEST

On to the Next Round

With the sell-off in equities intensifying this morning, Treasuries are finally finding some type of bid for a bounce right where they needed to.

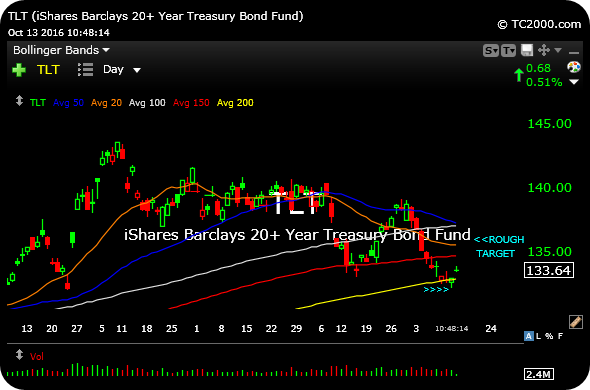

On the updated TLT (ETF for Treasuries) daily chart, below, buyers stepped in at the first 200-day moving average (yellow line) test since January. Yesterday's mini-reversal candle to green (arrows) amounted to temporary low.

But just because TLT is now bouncing does not mean a major bottom is at hand. In fact, given the overall corrective nature of the rate-sensitive complex, namely REITs and utilities, the presumption is that rallies will be potential short entries if and when they fail. In this case, TLT bouncing to about $136 is likely sufficient to shake out some late shorts and suck in new longs who assume a bottom.

At that point, I would be inclined to short the bounce.

All of that analysis out there, which is a considerable amount, that Treasuries simply must stay bid and rates must stay very low, fails to discount a scenario where the bond market stages a revolt against The Fed which has slowly but surely lost credibility over the years as they are essentially beholden to the market's machinations with their incessant, confusing, contradictory jaw-boning. In such a scenario with a bond market revolt, rates go higher due to the market's expression in a loss of confidence in The Fed's policies, rather than due to a macro belief.

Either way, after the initial leg down in the rate-sensitive complex, we are on to the next round in this fight to see how sustainable the inevitable oversold bounces in IYR TLT XLU are.

Saturday Night at Market Che... Fiesta Making a Run at Chotc...