13Oct10:54 amEST

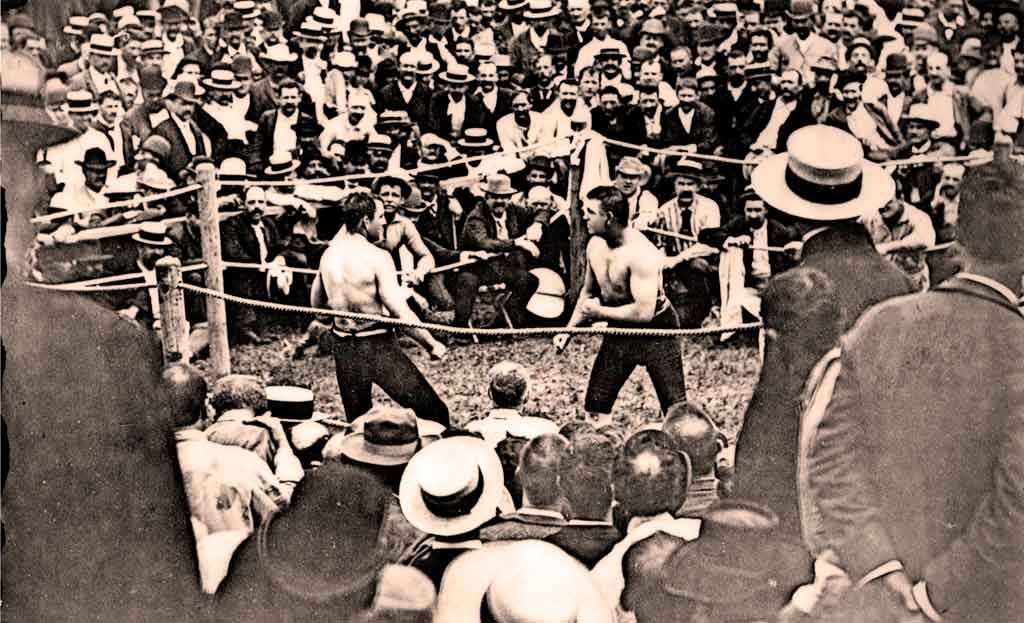

On to the Next Round

With the sell-off in equities intensifying this morning, Treasuries are finally finding some type of bid for a bounce right where they needed to.

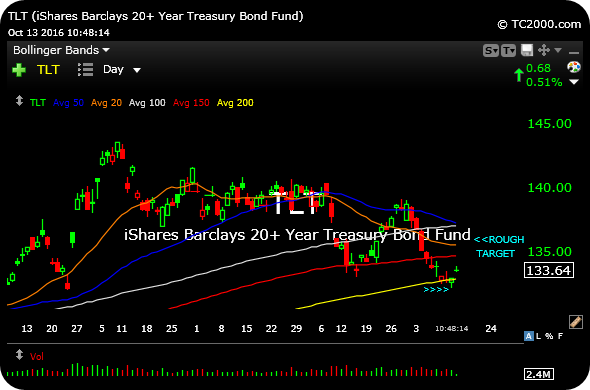

On the updated TLT (ETF for Treasuries) daily chart, below, buyers stepped in at the first 200-day moving average (yellow line) test since January. Yesterday's mini-reversal candle to green (arrows) amounted to temporary low.

But just because TLT is now bouncing does not mean a major bottom is at hand. In fact, given the overall corrective nature of the rate-sensitive complex, namely REITs and utilities, the presumption is that rallies will be potential short entries if and when they fail. In this case, TLT bouncing to about $136 is likely sufficient to shake out some late shorts and suck in new longs who assume a bottom.

At that point, I would be inclined to short the bounce.

All of that analysis out there, which is a considerable amount, that Treasuries simply must stay bid and rates must stay very low, fails to discount a scenario where the bond market stages a revolt against The Fed which has slowly but surely lost credibility over the years as they are essentially beholden to the market's machinations with their incessant, confusing, contradictory jaw-boning. In such a scenario with a bond market revolt, rates go higher due to the market's expression in a loss of confidence in The Fed's policies, rather than due to a macro belief.

Either way, after the initial leg down in the rate-sensitive complex, we are on to the next round in this fight to see how sustainable the inevitable oversold bounces in IYR TLT XLU are.