24Oct10:51 amEST

Bank Bears Need to Hold On

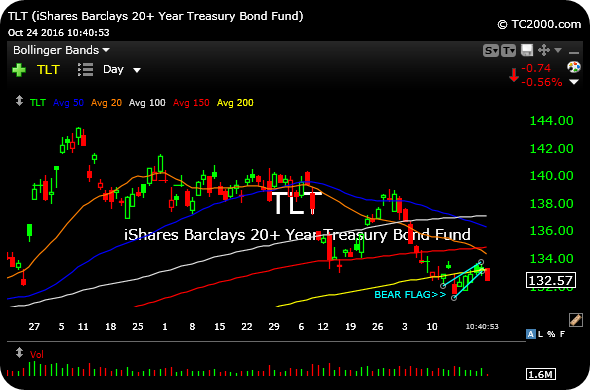

In the face of more weakness in Treasuries this morning, regional banks are gapping higher, by and large. As TLT moves lower, rates edge higher, which can often benefit financials.

While it is widely-known amongst market players and pundits that visible banking houses like GS and MS have been faring well lately, the regionals remain a bit of a wildcard in this environment. On the one hand, bank bears argue that some regionals pose serious risks, given their exposure to toxic energy debts. Moreover, perhaps for all financials, there is the recent weakness in BCS CS DB out of Europe with which to contend as an overhand for sector at-large.

But the energy and European bank concerns aside, bank bears simply have yet to seal the deal with a bonafide knockout punch. In fact, both KRE and XLF have steadily outperformed of late, basing tightly above their respective daily chart moving averages while other sectors like biotech have floundered.

If TLT confirms its bear flag, seen on the second daily chart, below, then I suspect the regional bank breakout, first below, may just be getting started.

Elsewhere, the T for TWX deal is helping the M&A spirit for bulls in general. I am tracking some other plays in the same sector for potential strength off this news, going forward.