28Oct10:51 amEST

Punt Team on the Field

After a GDP beat this morning, stocks are bouncing back from yesterday's selling. Small caps are higher by a but more than a third of one percent as I write this, enough to stave off an imminent wipeout but not enough to reverse the recent breakdown below $120 support on the IWM ETF.

Nasdaq stocks are largely trying to shrug off the AMZN sell-off, too. However, the bounce is far from a full-blown squeeze at this point. In fact, the action smacks of a "punt" into the weekend, with not much resolution about whether we would correct more and see the major indices follow the small cap in the Russell 2000 Index lower.

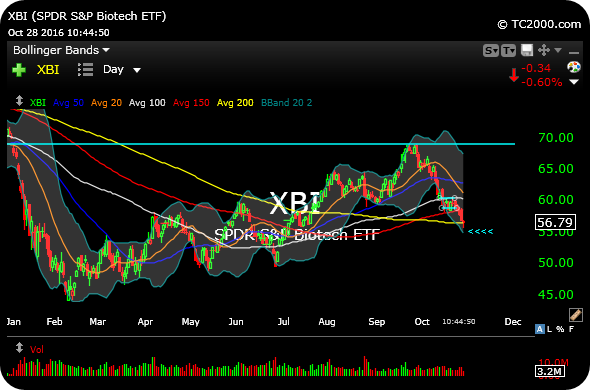

I am mostly keying off the biotechnology issues now, as the XBI (small/mid-cap biotech ETF) is attempting to reverse off its 200-day moving average (yellow line on daily chart, below). The XBI has arrived at its 200-day in steep fashion, meaning the bounces along the way have been few and far between. So, if buyers are going to stabilize the XBI (and IWM too with many smaller bios in the Russell), then now would be an opportune time to do so. Back under $55, however, and a wipeout scenario is back on the table.

Stock Market Recap 10/27/16 ... The Spookiest Chart of Them ...