09Nov10:42 amEST

Omarosa: If You Were Me, Who Would You Fire?

On the back of the surprise Trump victory, we are seeing a game of musical chairs below the market's surface. Ironically, it is reminiscent of a boardroom scene from "The Apprentice," in terms of discerning the winners and losers.

Firearms plays like RGR and SWHC are being sold aggressively, as are solar plays.

But banks, steels, and biotechs are the initial winners, with higher rates contributing to the strength in finials, as well.

So with this picking and choosing of Trump winners, we must also look at the "meat and potatoes" of energy plays in lieu of green, alternative energy.

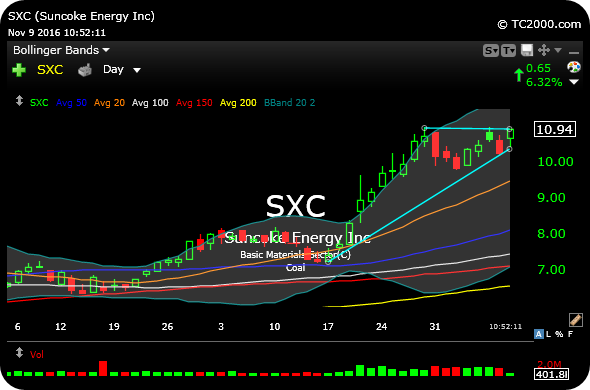

Last week, we put out a note talking about the major coal play SXC, as well as the failed bottoming attempt in solar play FSLR. In hindsight, perhaps that was a "tell" regarding the Trump.

In the present moment, midwest coal play SXC still looks enticing on the long side. On the updated daily chart, below, a move back over $10.90 should help catapult the firm to a fresh breakout.

Regarding solars, on the other hand, as a group they remain decidedly hands-off with both technicals and the political winds providing strong resistance to any and all rally attempts.

Stock Market Recap 11/08/16 ... Still the Most Important Lon...