22Nov1:31 pmEST

It's That Time of Year: Tom Brady and Uggs

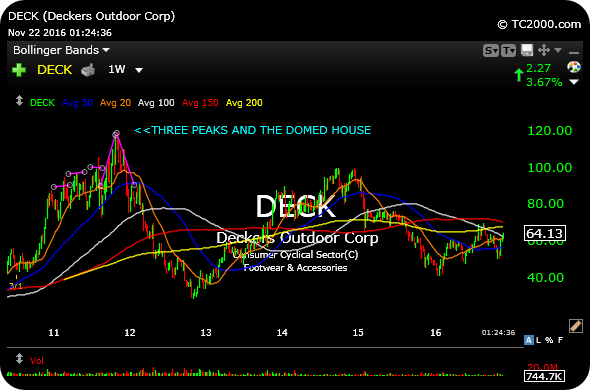

Long-time readers will recall that the chart of Deckers back in 2011 served as a rare example of George Lindsay's, "Three Peaks and Domed House" chart pattern. We walked through DECK's top back then, as it confirmed lower for a vicious downtrend. And the name has since seen a sharp rally into late-2014 only to then correct sharply, once again.

At issue now is whether the specialty retail footwear play is ripe for a seasonal rally as we head into the cold weather months.

On the weekly chart, below, DECK is trying to scallop out a good low above $60. Earnings are out of the way, and with the retail sector as a whole acting better in November, this one should be back on the radar long as long as $60 now holds as support.

At a minimum, we have some rotation out of biotech and most healthcare this autumn and into the likes of the retail and transportation stocks, among other prior laggards.

More on the market at-large in my usual Midday Video for Members.

Saturday Night at Market Che... Chart Requests from Good Fri...