01Dec10:56 amEST

Circle of Life and of Bull Markets

After a good while of leading, technology (especially chips and "FANG" names) as well as bonds and rate-sensitive sectors are suddenly in the outhouse, with the penthouse being occupied by the energy complex as well as financials.

I am generalize a bit, of course. But the gist of the price action is such that these rotations are becoming increasingly pronounced.

Bears will argue that these types of rotations occur in late-stage bull runs and are symptomatic of a bull on its last legs. However, they can drag on for months, as we saw from January-June 2008, quite a long time indeed to go if you were fighting the rotations back then.

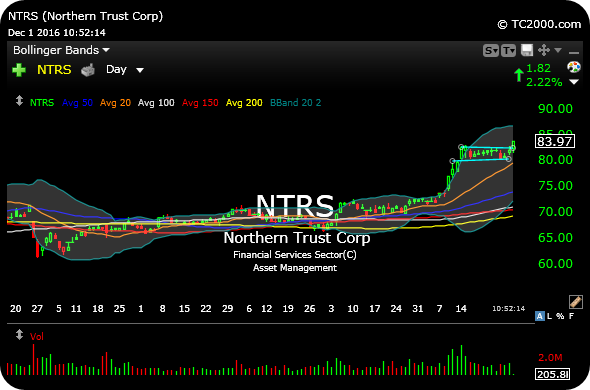

Thus, a name like Northern Trust, below on the daily chart, is not only unperturbed by the outflows seen in the QQQ, but is likely the beneficiary of such capital as you can plainly see.

We have a few other similar plays on watch for Members this morning, looking to see if a few names in the asset management and exchange space can catch-up to the financials as rates go higher yet.