08Dec1:37 pmEST

Why is VIX All Alone? No Friends, No Friends

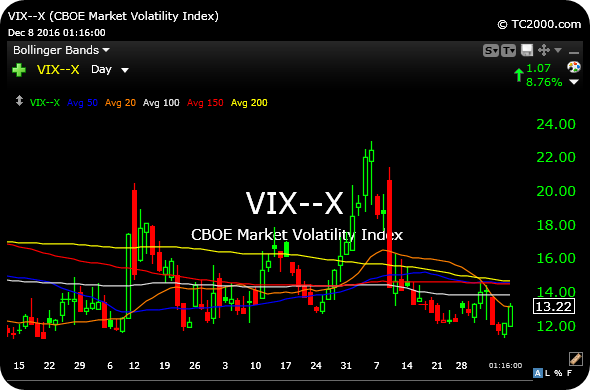

The typically-destitute VIX (CBOE Market Volatility Index, measuring "fear" as a proxy from the options market) is higher for the second day in a row, today up a reasonable amount considering indices are squeezing higher yet.

When the VIX is below 20, as a general rule, and VIX futures are in contango, it is tough to get too excited about being long volatility for anything more than a quick scalp, if that.

But when the VIX diverges from stocks like it is today, it raises a few interesting points about sentiment, some of which may surprise you. Long story short: The VIX higher with stocks does not equate to a slam-dunk bearish divergence in stocks. I will follow-up on this for Members in my usual Midday Video now.

Elsewhere, today is likely a good day to cut names not acting right, such as TWLO, which probably should be rallying sharply with stocks. Instead, the momentum name and recent IPO is on the cusp of breaking to multi-month lows.