22Mar10:37 amEST

Intermission or the End?

After yesterday's violent reversal across the major averages for stocks, quite a few are already proclaiming the "pullback" to be over or near completion. A failed early bounce attempt this morning is not helping that thesis, with the small caps in the Russell 2000 Index most notably giving up the ghost.

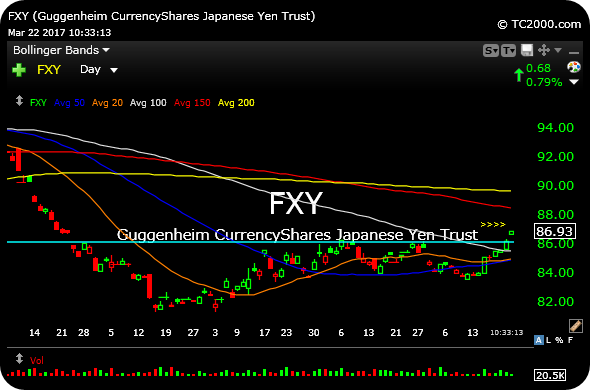

Another factor to consider in terms of whether the market pullback has another act or two in its theatrical performance is the Japanese Yen.

On the FXY (ETF for the Yen versus a basket of developed economies' currencies) daily chart, below, one of our Members astutely noted the Yen clearing multi-month resistance over $86.

The reason why the Yen is relevant for stock traders is that, oftentimes, a strengthening Yen can mean global "risk off," especially regarding equities--An inverse relationship, if you will.

Thus, going forward as long as stocks remain unable to sustain bounces I have my eye on the Yen to see if its rally gathers steam.

Stock Market Recap 03/21/17 ... A Squeeze Play with Two Outs