07Apr12:48 pmEST

The Last Good Hustle

In light of some buzz earlier this year about Warren Buffett and Charlie Munger at Berkshire Hathaway singing a much more bullish tune on the airline sector than at any other time in their (extensive) lives, one cannot help but speculate on which airlines may be most ripe for a Berkshire buyout.

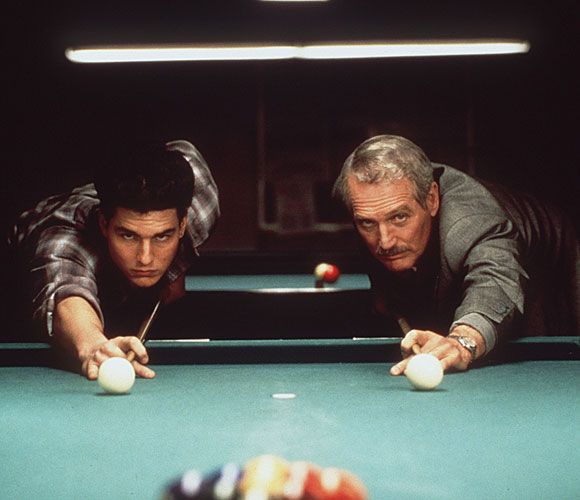

Much like "Fast Eddie" Felson in The Color of Money (1986), Buffett may be looking for a sexy play in the twilight of his life, if for no other reason (beyond the usual Berkshire lip service about "buying the business") than to leave a strong impression to the many young(er) whippersnappers in the proverbial pool halls (hedge funds) that the old man has still got it--Always has and always will.

From a market capitalization standpoint, JetBlue Airways seems like a decent bet. JBLU has made strides to improve its service, first and foremost, including a highly ranked revamped first class variation called "JetBlue Mint." With a current market cap of $7.13 billion, Berkshire would not be necessarily breaking the bank to buy the firm out, either.

However, JBLU was actually a glaring omission from Berkshire's airline buying spree last year.

So what gives?

Buffett may be pulling a bit of misdirection here, trying to get JBLU as cheap as possible. Or he may not be a believer. But, again from a market cap perspective as well as potential growth in an industry he suddenly likes, JBLU does make sense as a Berkshire prospect.

Technically, the airline has had several quarters now to work off rather overbought conditions after previously running into its 2003 prior all-time highs in 2015. I was bearish on the name back then, but now JBLU may be ready for a new leg in its journey, with or without Fast Eddie backing it.

The Best of War and More: Sp... Saturday Night at Market Che...