21Apr10:56 amEST

No Glory Days for SLoB

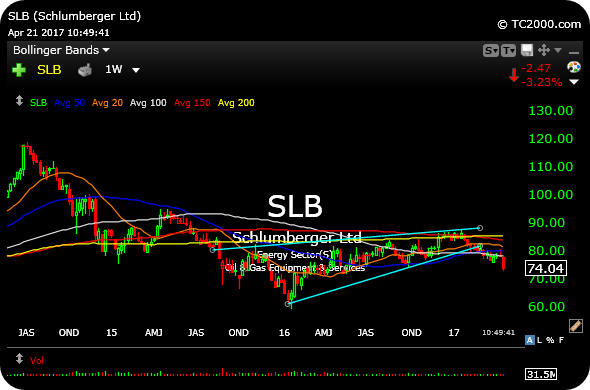

Oil services giant, Schlumberger, below on the weekly timeframe, is down more than 3% after earnings this morning. For a while now, the energy sector has lagged equites in general, with energy stocks themselves lagging crude oil at various junctures, too. Typically, when commodity-derived stocks lag the actual commodity's performance it is a particularly cautionary sign.

And that certainly seems to be the case with energy stocks, beyond the oil services segment. Indeed, large cap integrated firms like CVX HES XOM all continue to underwhelm, and the higher beta plays like CHK PXD SWN simply have been unable to hold seemingly promising bounces.

Still, the dismal performance in energy has been largely ignored by broad market bulls. Thus far, that has been a checkmark in the bullish column as yet another sign of resilience.

However, is Schlumberger (or "SLoB" as it is known, derived from its ticker symbol, SLB), revisits its early-2016 lows it may cause a bit more consternation in the broad market than bulls would like to see.

As we have noted before, bulls do not necessarily need energy stocks to make new highs. But they likely do need them to at least not fall apart and stage fresh legs down. Similar comments apply to the large cap biotechnology stocks in the IBB ETF.

Beyond the French election, we are watching the persistent weakness in the energy space into next week and beyond for clues.

Stock Market Recap 04/20/17 ... Will Citi Get Another Bailou...