11May1:32 pmEST

Just Keep it Moving

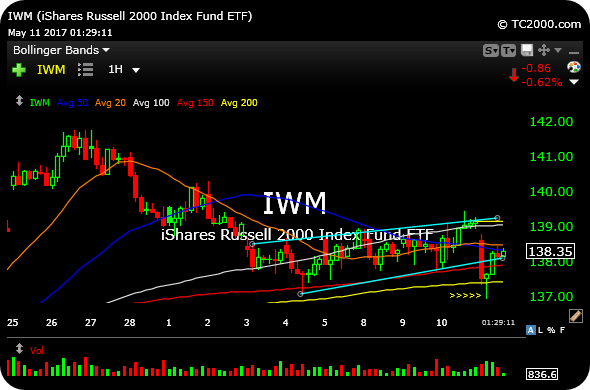

It is almost breathtaking to see the manner in which buyers immediately recovered the breached and important $138 level on the Russell 2000's ETF, IWM, today. The reason why $138 has become such a critical battleground area is the number of tests just above and below it we have seen of late. Clearly, an epic battle is taking place and one side is likely close to finally gaining the upper hand. For near-term traders, it is key to keep moving along and not allow frustration to set in via over-trading a choppy market.

To the chagrin of bears, when we see the hourly chart for IWM, updated below, since late-April they have had numerous chances (nearly too many to count) to decisively break $138 and send small cap longs squirming for help.

So the risk to the bear case now is that this morning's push down and subsequent upside reversal (arrows) will amount to being nothing more than the final shakeout before markets gear up for a new leg higher.

That is the clear bull case here, at least.

My take: Not much has changed since this morning's post--We are looking to see whether dip-buyers can hold this progress deep into the afternoon before rushing to judgment one way or the other. Clearly, plenty of individual charts are holding up and acting well even.

Elsewhere, natural gas has my eye on the long side more than crude. I will run through those charts and plenty more in my usual Midday Video for Members.