17May1:34 pmEST

No Big Deal: Just a Nine-Year Bear Market Bottom

Lost in the shuffle of headlines out of Washington D.C. alongside equities finally seeing some downside movement today is the persistent strength in the Euro currency.

For a while now, Europe's future has been uncertain, especially dating back to the BREXIT upset vote last summer.

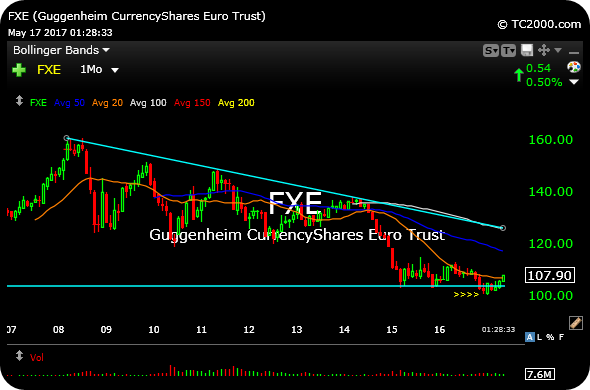

However, the Euro currency also priced in plenty of uncertainty and bad news along the way, as you can see the currency's ETF (versus a basket of developed-economy currencies) sporting a nine-year downtrend since 2008. Indeed, the monthly chart, below, has been the essence of a ferocious, long-term downtrend.

But the Euro recently made some technical progress, with its daily chart showing price recapturing the 200-day moving average and pushing higher yet today. As an aside, also note the Euro seems to be moving higher with precious metals.

Back to the monthly chart, what piques my interest most here from a contrarian bullish standpoint is that the Euro briefly breached its prior lows in late-2016 (arrows) from 2015, only to now aggressively recover them.

Thus, the case for a meaningful change in character is present. We have also been more sanguine about the prospects of the British Pound Sterling, as well as the Swiss Franc. Of course, a weak U.S. Dollar should help those currencies and gold, to boot.

Going forward, we want to see the Euro ETF clear the $113 level, above. Even through calls for a new bull market are premature here, the Euro ETF testing its multi-year resistance trend (upper light blue line) is certainly a viable scenario into the back half of this year.

More on equities in my usual Midday Video for Members.