18May10:38 amEST

The General Rule Regarding Exogenous Events and the Aftermath

Markets have suddenly been jolted by a high speed news cycle which, unlike recent history, is actually impacting stocks.

Indeed, the news flow about President Trump has been enough to serve as either the catalyst or perhaps a long overdue excuse for volatility to pop as stocks dropped hard yesterday. But react they did, nonetheless, which stands in stark contrast to the previously unperturbed, aloof, drift higher.

And now this morning we have news of Brazil's president accused of bribery. Without question, Brazilian stocks are adopting the old motto regarding exogenous events of "Shoot (sell) first; Ask questions later."

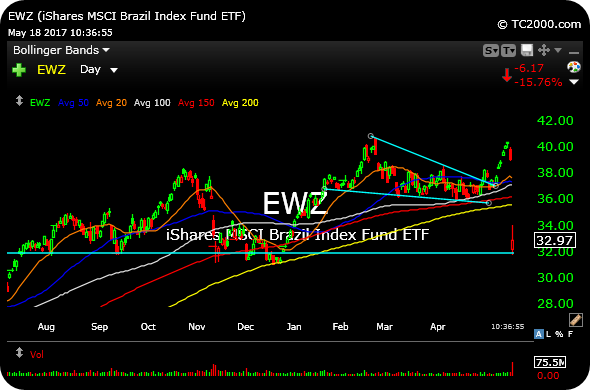

Now, regarding the topic of "exogenous events," understand we are talking about, generally, events which essentially blindside markets and seemingly demand an immediate repricing of risk. When you see the Brazil country ETF, EWZ, below on the daily timeframe, recently break out on pretty good buy volume but swoon more than 16% today, it is a good piece of evidence that many a market player of size got essentially blindsided by this news.

The issue then becomes whether the sell-off (both in the U.S. and Brazil) is overdone and thus presents a buying opportunity.

In determining the answer that question, we need to strongly consider whether these events, meaning the Trump obstruction issue and the Brazil bribery one, are now mostly known to markets without any other major issues like that coming to light soon. In other words, if these are one-off, single issue exogenous events then markets may quickly firm up and resume their technical uptrends, Brazil included.

Alternatively, if these exogenous events are merely the beginning of a series of unresolved issues, then markets have indeed be at major turning points.

Thus, we are looking to see if the shock wears off alongside volatility, and if markets revert back to essentially ignoring breaking news.

Regarding EWZ, the monstrous gap down to $32 markets significant prior support. If this truly is a one-issue exogenous event for Brazil, I expect this level to hold into the summer months and for buyers to defend any dips below it.

Stock Market Recap 05/17/17 ... Unsaturated Markets for Satu...