07Jul2:44 pmEST

Suddenly Stranded in the Heat of Competition

Amid the focus today on sharp, snapback rallies in the likes of AAOI, not to mention plenty of traders eyeballing TSLA for a possible oversold bounce, it is worth noting that bond bulls have suddenly become a quiet bunch after professing victory in recent weeks.

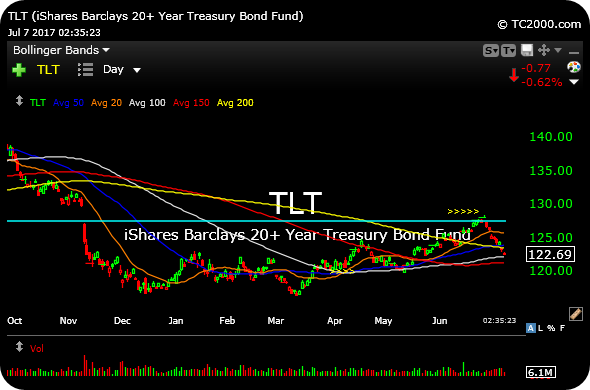

Specifically, using TLT as a proxy, below on the daily chart, you will note the really in Treasuries had continued since become Memorial Day into late-June.

But as TLT rallied, the rate-sensitive sector began to diverge, namely weakness in utilities, consumer staples, and now REITs, did not seem to jive with the notion of rates heading southbound, once again.

Just as is the case with most divergences, they are often puzzling and not necessarily actionable. After all, correlations are made to be broken.

However, when they do flash true signals we want to take notice. And in this case as TLT falls sharply back below its still-declining 200-day moving average (yellow line), it could easily presage a further spike in rates this summer as TLT (bond prices) keeps heading on down. Also note Monday, June 26th as a classic reversal pattern with the prior and subsequent session's gaps on ether side of that candlestick, leaving bond bulls suddenly stranded above the 200-day now.

Longer-term, we still think rates on the 10-year Note need to spike over 3% again for there to be a multi-decade change in trend since Paul Volcker fought the back off inflation in the early-1980s.

Nonetheless, the TLT weakness is now confirming the IYR XLP XLU selloffs and ought to be watched closely this summer.

Nothing But a Bastard from a... Saturday Night at Market Che...