02Aug2:59 pmEST

The Eternal Battlefield

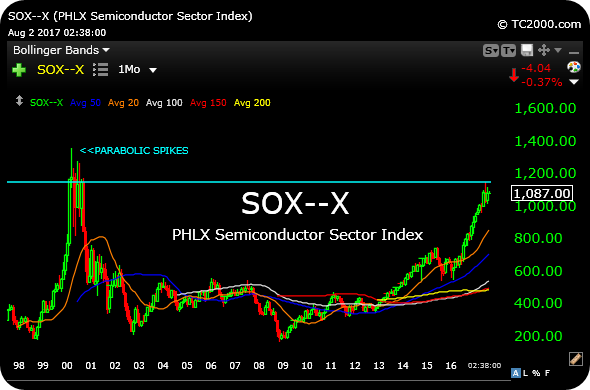

Even though both the Nasdaq Composite Index and the QQQ (ETF for the top 100 stocks in the Nasdaq) both long ago left their prior dot-com bubble highs in the dust, a lingering issue from a long-term perspective has been that the semiconductors, the sector at the heart of the dot-com bubble run-up, have yet to adequately conquer their demons from that eternal battlefield.

On the SOX monthly chart, below, note the Philadelphia Semiconductor Index finding some supply, or initial resistance, right at the area before the dot-com parabolic spikes higher became so violent back in 2000 as to closely resemble the grand finale of a July 4th fireworks show.

Some initial resistance here is fine and ought to be expected, even by the most steadfast of semiconductor bulls.

However, we are also seeing some sharp earnings selloffs in the space, namely from COHR and KLIC today. AAOI has earnings tomorrow, and NVDA next week, both of which could sway the sector for the rest of summer trading.

So while the initial pause from the chips back in early-June was overdue, at this point semiconductor bulls will want to keep a floor under the sector as some earnings blowups threaten to take the sector into a deeper pullback.