28Aug1:33 pmEST

The Blueprint for a Bullish Sector Catalyst

It is safe to say that the amount of mergers & acquisitions in 2017 has been underwhelming, especially when you consider the expectations for stock market bulls and the seemingly inevitable flurry of deals which we can expect when the indices make new all-time highs in such a manner like the senior indices have this year.

Still, the AMZN for WFM deal this summer and now the GILD for KITE buyout this morning is certainly renewing glimmers of hope for a post-Labor Day spurt of dealmaking.

Should a new batch of significant M&A occur, it may very well be sufficient to keep stock market bears at bay--Mind you, a further pullback on the senior indices is certainly possible. But in terms of staving off a deep correction or new bear market, M&A is a classic late-stage bull market weapon to blunt the ursine attacks.

As far as biotech is concerning, the IBB and XBI ETFs are both flashing promising signs in their own right, as those sector ETFs are gapping clearly above their respective 50-day moving averages.

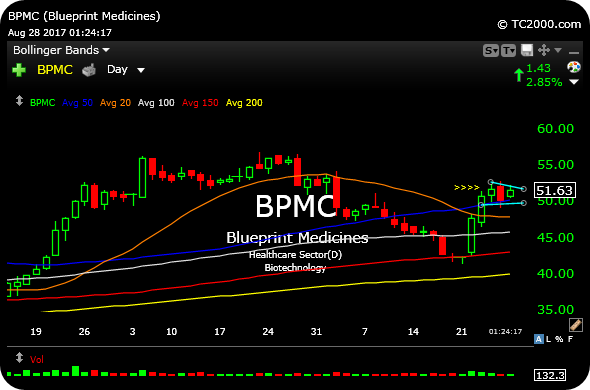

Blueprint Medicines, below on the daily chart, is just one example of the type of buyout target we seek out for Members--We want to stay disciplined and focus on those long setups with quality charts. This way, if the buyout does not materialize, we are still long a sound setup and not simply playing the roulette table randomly.