20Sep1:26 pmEST

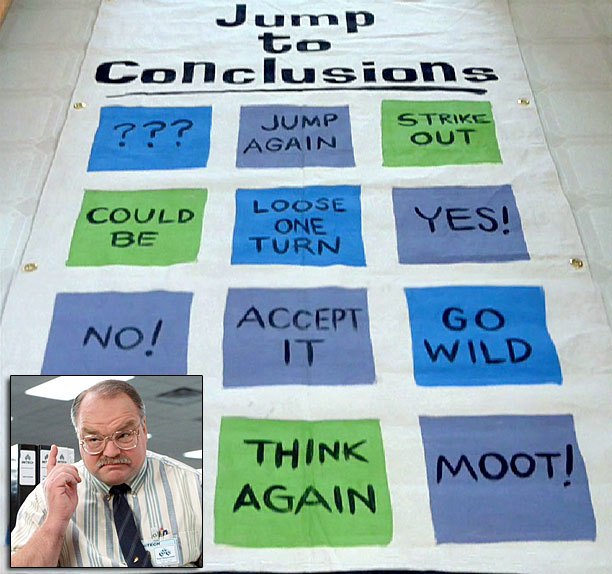

Don't Forget Your Jump to Conclusions Fed Day Mat

Despite the major averages not giving the impression of too much action today, some sectors like energy, materials, biotechs, and transports are inspiring bulls.

Nonetheless, it is worth reiterating that we have a known, defined risk event at the bottom of the hour through the end of the session today in terms of the FOMC, the Fed forecasts, and Chair Yellen's presser.

True, that may be a non-event in terms of the market possibly shrugging it all off anywhere, regardless of what is decided about rates and what is implied for the future policy decisions.

But it is still a standard risk event, where jumping to too many conclusions beforehand is usually not prudent. And I will be more inclined to dabble in the hot sectors with more longs if they maintain their strength into the bell and tomorrow, too.

Another theme today is AAPL weakness, still seeing a sell-the-news reaction from their event earlier this week. AAPL is currently testing its 50-day moving average for the first since since August 1st. But while that is happening, as one of our Members noted, BlackBerry is making a move, quietly, again to try to turn around its long-term laggard status.