26Oct10:20 amEST

Sounds Like a Bird

The headlines off Twitter's earnings report this morning are mostly focusing on the idea that the long-time social media laggard could finally turn a profit sometime soon. If Twitter were a young athlete, we would say that TWTR had tons of raw, but undeveloped talent. In other words, TWTR has all the potential in the world to be a dominant social media firm, but they need to show Wall Street that they are making meaningful progress.

It may easy to forget, but at one time Facebook was seen in a similar light. After its mid-2012 IPO, FB's stock struggled mightily and took the brunt of harsh criticism, both in terms of the firm's direction as well as its share price performance. All of that, however, changed in a heartbeat in the summer of 2013, as FB gapped up after an earnings report and never looked back.

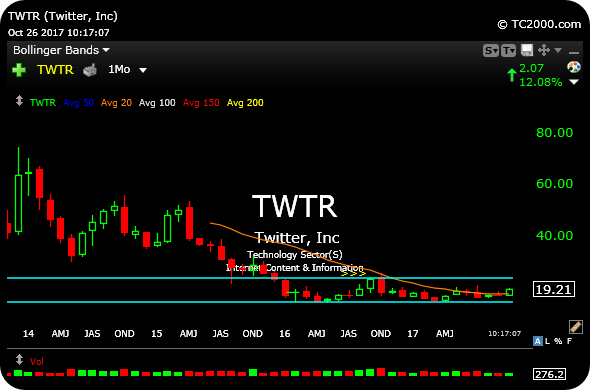

Now, that analogy may be a bit too optimistic for TWTR at the moment. But when we see the TWTR monthly chart, second below, one can see the potential for a massive base bottom in place, with $14, then $16 both having held valiantly in recently quarters as firm support.

On the daily chart, first below, TWTR filled its $19.27 open gap from last earnings report (a dud, which resulted in a fierce gap down). Coming to terms with that $19.27 area will be the short-term test of mettle for the stock.

If the Facebook analogy holds true, then fund managers could easily chase TWTR up from here.

Other than that, we are looking to see whether TWTR displays changes in character off this report, meaning we do not see much giveback of this move going forward.

They're Not Playing for a Hi... Saturday Night at Market Che...